Portfolio Manager

From MTHWiki

(New page: Image:Portfoliomanager.png) |

|||

| Line 1: | Line 1: | ||

| + | [[My_Money_2.0_Manual | '''My Money 2.0 Manual''']] | ||

| + | |||

| + | |||

| + | == Overview == | ||

| + | |||

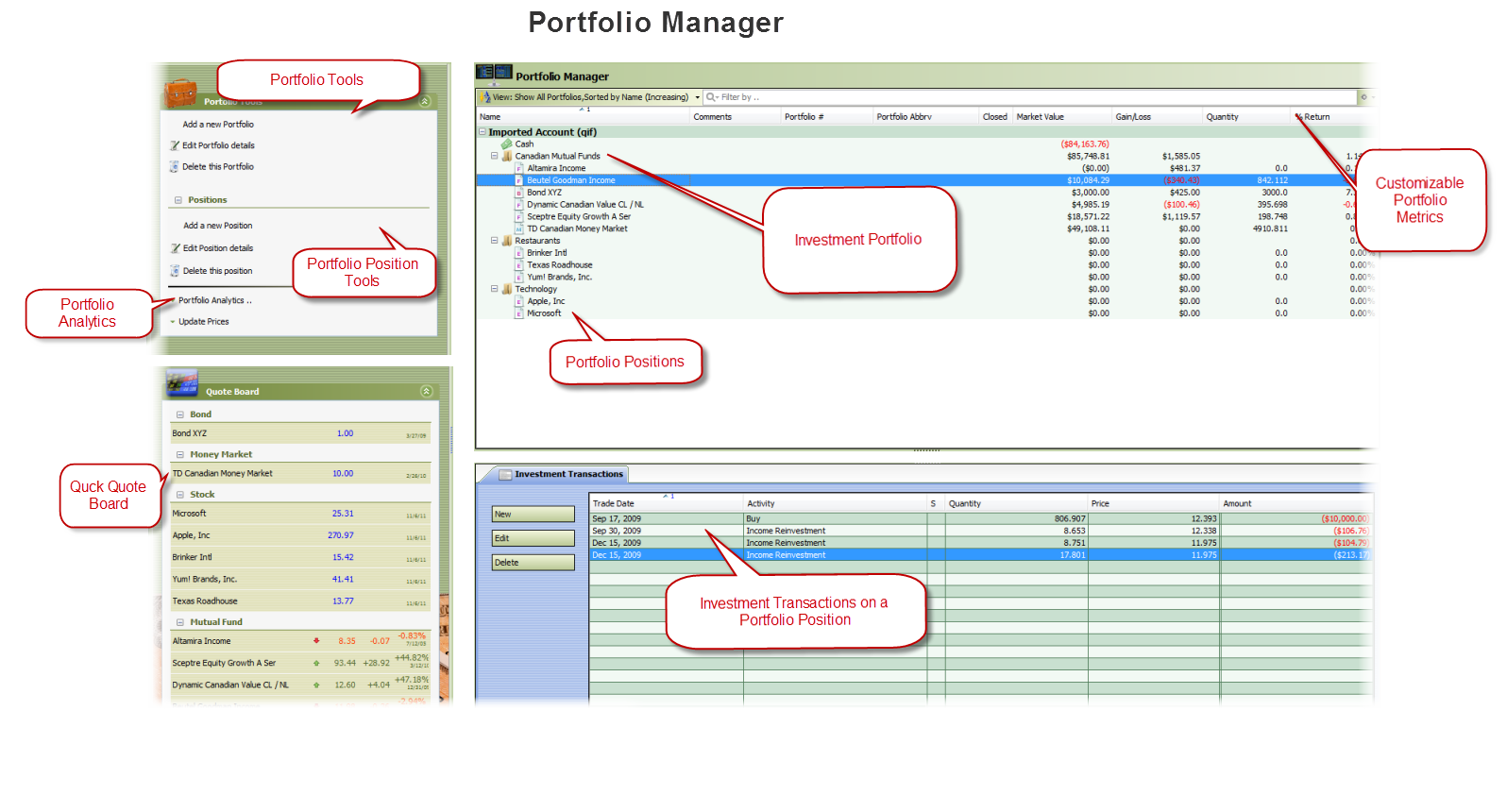

| + | Portfolio Manager is an investments management tool that allows you to track and assess your holdings in stocks, bonds and other financial instruments. Whether you are a casual investor or an experienced trader, Portfolio Manager can help you set investment priorities, identify under-performing investments and verify efficiency improvements. | ||

| + | |||

| + | Portfolio Manager enables you to measure and understand every aspect of your financial returns including: | ||

| + | |||

| + | * Keep track of all your trading activities. | ||

| + | * Always know your trading performance. | ||

| + | * Perfect for all types of traders/investors. | ||

| + | * Trade in multiple-currencies. | ||

| + | * Charts, technical analysis. | ||

| + | * Manage your trading with total control. | ||

| + | |||

| + | |||

| + | == Investment Records Management == | ||

| + | |||

| + | Within MyMoney groups of assets are categorized as Portfolios. A portfolio might include | ||

| + | |||

| + | |||

| + | #Stocks | ||

| + | #Bonds | ||

| + | #U.S. Treasuries | ||

| + | #Mutual Funds | ||

| + | #Currencies | ||

| + | #Index Funds | ||

| + | #Money Market Funds and | ||

| + | #Other financial instruments | ||

| + | |||

| + | |||

| + | Portfolios holdings are further aggregated into Positions, that are classified as the amount of a security either owned (a long position) or owed (a short position). | ||

| + | |||

| + | You are not limited to a single Portfolio per Account, you can track an unlimited number of hierarchical Account Portfolios. Sub-portfolios are useful for organizing your investments into specific areas, and/or for investment advisors tracking investments for multiple clients | ||

| + | |||

| + | When creating new investments for your account you can either record all the historical transactions, or enter starting positions as of a specified date. It is preferable to record all the historical transactions, as this enables accurate performance reporting over past time periods. In cases where the historical data are unavailable or impractical to enter, you may use starting positions. | ||

| + | |||

| + | Historical transactions can be retrieved automatically, imported from a file, or entered manually. In order to retrieve historical transactions, your account must be available from one of the supported brokerage or mutual fund companies. The term "retrieve" is used when Portfolio Manager connects via the internet and automatically obtains your data. The term "import" is used when you have your data in a file, and Portfolio Manager reads in the data from this file. Portfolio Manager can import transactions and positions from a wide variety of files. | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

[[Image:Portfoliomanager.png]] | [[Image:Portfoliomanager.png]] | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | [[My_Money_2.0_Manual | '''My Money 2.0 Manual''']] | ||

Revision as of 18:51, 25 June 2010

Overview

Portfolio Manager is an investments management tool that allows you to track and assess your holdings in stocks, bonds and other financial instruments. Whether you are a casual investor or an experienced trader, Portfolio Manager can help you set investment priorities, identify under-performing investments and verify efficiency improvements.

Portfolio Manager enables you to measure and understand every aspect of your financial returns including:

- Keep track of all your trading activities.

- Always know your trading performance.

- Perfect for all types of traders/investors.

- Trade in multiple-currencies.

- Charts, technical analysis.

- Manage your trading with total control.

Investment Records Management

Within MyMoney groups of assets are categorized as Portfolios. A portfolio might include

- Stocks

- Bonds

- U.S. Treasuries

- Mutual Funds

- Currencies

- Index Funds

- Money Market Funds and

- Other financial instruments

Portfolios holdings are further aggregated into Positions, that are classified as the amount of a security either owned (a long position) or owed (a short position).

You are not limited to a single Portfolio per Account, you can track an unlimited number of hierarchical Account Portfolios. Sub-portfolios are useful for organizing your investments into specific areas, and/or for investment advisors tracking investments for multiple clients

When creating new investments for your account you can either record all the historical transactions, or enter starting positions as of a specified date. It is preferable to record all the historical transactions, as this enables accurate performance reporting over past time periods. In cases where the historical data are unavailable or impractical to enter, you may use starting positions.

Historical transactions can be retrieved automatically, imported from a file, or entered manually. In order to retrieve historical transactions, your account must be available from one of the supported brokerage or mutual fund companies. The term "retrieve" is used when Portfolio Manager connects via the internet and automatically obtains your data. The term "import" is used when you have your data in a file, and Portfolio Manager reads in the data from this file. Portfolio Manager can import transactions and positions from a wide variety of files.