Portfolio Manager

From MTHWiki

My Money 2.0 Manual | Downloading transactions from a website <<Previous | Next>>Adding New Investment Accounts

Contents |

Overview

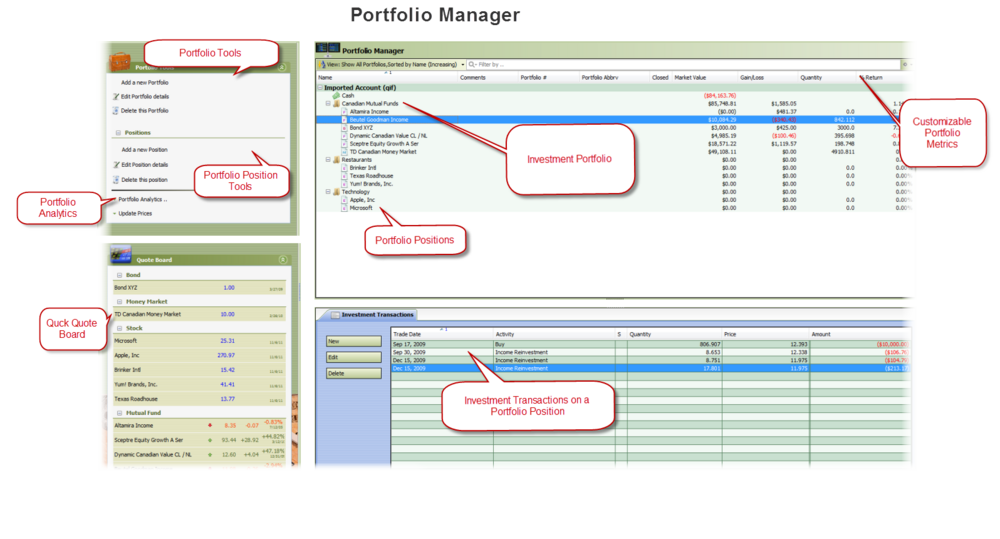

Portfolio Manager is an investments management tool that allows you to track and assess your holdings in stocks, bonds and other financial instruments. Whether you are a casual investor or an experienced trader, Portfolio Manager can help you set investment priorities, identify under-performing investments and verify efficiency improvements.

Portfolio Manager enables you to measure and understand every aspect of your financial returns including:

- Keep track of all your trading activities.

- Always know your trading performance.

- Perfect for all types of traders/investors.

- Trade in multiple-currencies.

- Charts, technical analysis.

- Manage your trading with total control.

Portfolio Manager and the real world

Investment Accounts in MyMoney may or may not be connected to brokerages or other financial systems. If a user's MyMoney account shows the user as holding a particular position, that doesn't necessarily mean the user actually holds that position in the real world.

Transactions that users create in MyMoney don't have any effect on the real world. If MyMoney creates a Buy order for 50 shares of AAPL, that doesn't cause the user to actually purchase anything; the only thing that changes is the user's position information in their MyMoney account.

Conversely, if the user performs a real-world transaction through a brokerage or other system, then their MyMoney account doesn't get updated until they use a account synchronization (or the GUI) to send the information about the transaction to MyMoney.

However, the market values, returns, and gains provided in MyMoney do use real-world market data, so if a user accurately records their transactions, then the performance data provided by MyMoney is accurate.

Investment Records Management

Within MyMoney groups of assets are categorized as Portfolios. A portfolio may contain any combination of the following assets:

- Stocks

- Bonds

- U.S. Treasuries

- Mutual Funds

- Currencies

- Index Funds

- Money Market Funds and

- Other financial instruments

Portfolios holdings are further aggregated into Positions, that are classified as the amount of a security either owned (a long position) or owed (a short position).

You are not limited to a single Portfolio per Account, you can track an unlimited number of hierarchical Account Portfolios. Portfolios are useful for organizing your investments into specific areas, and/or for investment advisers tracking investments for multiple clients

When creating new investments for your account you can either record all the historical transactions, or enter starting positions as of a specified date. It is preferable to record all the historical transactions, as this enables accurate performance reporting over past time periods. In cases where the historical data are unavailable or impractical to enter, you may use starting positions.

Historical transactions can be retrieved automatically, imported from a file, or entered manually. In order to retrieve historical transactions, your account must be available from one of the supported brokerage or mutual fund companies. The term "retrieve" is used when Portfolio Manager connects via the internet and automatically obtains your data. The term "import" is used when you have your data in a file, and Portfolio Manager reads in the data from this file. Portfolio Manager can import transactions and positions from a wide variety of files.

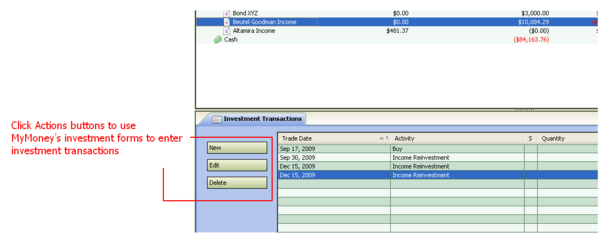

By default, Portfolios are grouped by the accounts in which they are held. To view the Investment Positions click the plus sign (+) to the left of an item and My Money will show current positions. To view the transactions for an Investment Position simply select it and MyMoney will retrieve and show purchases, sales, and other activities that have been executed on that investment in Investments Transactions window at the lower half of the Portfolio Manager screen.

Portfolio Window

Use the Portfolio window to view summary information for all securities in which you hold an open position. You can customize the information you see in the Portfolio window in several ways.

- You can change which columns are displayed and how and where they are displayed, and

- you can change the order in which securities are listed and how they are grouped.

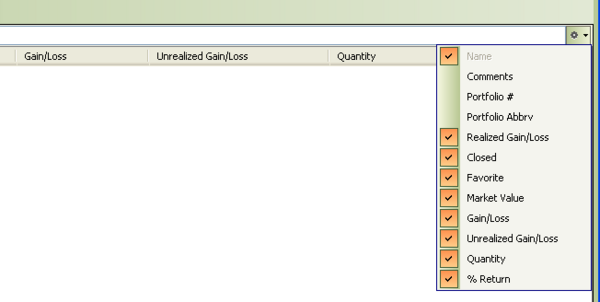

Customizing Portfolio tables

You can customize the layout of the main portfolio window to better suit your personal tastes.

To change which columns are displayed in the Portfolio window please click the Customize button in the upper right corner of the window. There are eleven different investment performance metrics to select from, to help you instantly gain different perspectives on your investments:

| Column Heading | Description |

| Name | Portfolio Name, as you entered it in Edit Portfolio dialog (up to 100 characters in length) |

| Comments | Portfolio Comments (up to 256 characters in length) |

| Portfolio # | Portfolio Number (up to 12 characters in length) |

| Portfolio Abbrv | Portfolio Abbreviation (up to 12 characters in length) |

| Realized Gain/Loss | Realized short-term and long-term gain or loss |

| Closed | Indicates whether the Investment Account is closed |

| Favorite | Indicates whether the Investment Account is marked as Favorite |

| Market Value | Current price multiplied by the number of shares you own |

| Gain/Loss | Gain or loss of all currently-held shares of the security.

This is the market value of the shares minus the cost basis |

| Unrealized Gain/Loss | Unrealized (hypothetical) short-term and long-term gain or loss |

| Quantity | Total number of currently-held units or shares of the security. |

| % Return | Internal Rate of Return (IRR) |

For explanations on how MyMoney calculates a particular metric please see Gain, Market Value, Cost Basis - How does My Money calculate Gain, Market Value, and Cost Basis

The Register Window

Each Investment Position has its own register that functions much like the registers for other types of MyMoney accounts. Use the Register window to view all the transactions that have been entered on a Position.

Quote Board

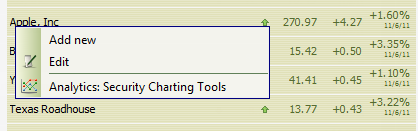

Most recent security prices and other relevant information are displayed on a QuoteBoard. If price has been updated automatically then the price displayed is the closing price (the last price quoted on a stock exchange during a day). If the price has been updated manually then the price is the last updated price. Please note that security transaction history is queried to determine the last transactional price of a security

See Updating Security Prices for more information on Security Price updates

The Quote Board is useful for accessing all kinds of information related to a particular security. If you click on a security name you will be prompted with a menu allowing you to Add new Securities to the board, Edit clicked Security or to Access Security Charting Tools.

My Money 2.0 Manual | Downloading transactions from a website <<Previous | Next>>Adding New Investment Accounts