Technical Indicators and Oscillators

From MTHWiki

My Money 2.0 Manual | Investment Charts<<Previous | Next>>The Money Reports Gallery

Overview

MyMoney enables you to conduct a more thorough technical analysis utilizing the Technical Indicators and Oscillators functionality in your charts. Technical indicators are tools used by market technicians to determine trend, market sentiment and various buy and sell signals.

Most Indicators plot series of data points that are derived by applying a formula to the price data of a security. Price data includes any combination of the open, high, low or close over a period of time. Some indicators may use only the closing prices, while others incorporate volume and open interest into their formulas. The price data is entered into the formula and a data point is produced.

An indicator offers a different perspective from which to analyze the price action. Some, such as moving averages, are derived from simple formulas and the mechanics are relatively easy to understand. Others, such as Stochastics, have complex formulas and require more study to fully understand and appreciate. Regardless of the complexity of the formula, technical indicators can provide unique perspective on the strength and direction of the underlying price action. For example, a simple moving average is an indicator that calculates the average price of a security over a specified number of periods. If a security is exceptionally volatile, then a moving average will help to smooth the data. A moving average filters out random noise and offers a smoother perspective of the price action.

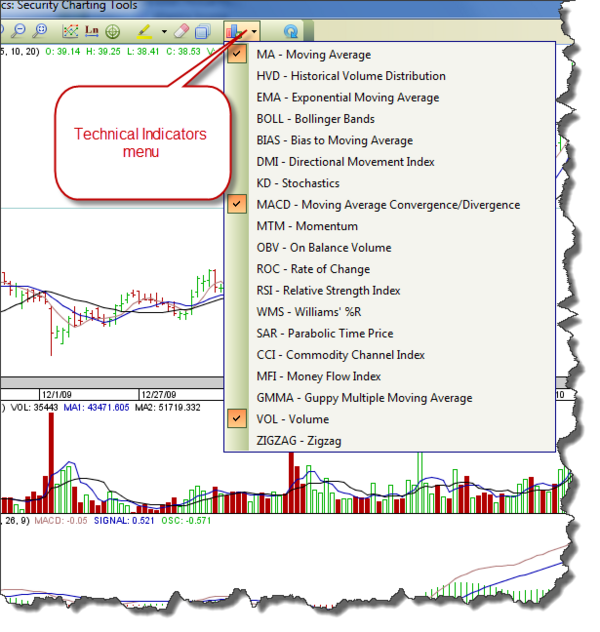

MyMoney supports over 18 technical indicators and oscillators and support for more is planned for the future.

To access Technical Indicators menu functions please press the indicators button on the Investments Charts toolbar, as you do so, a new window will appear listing all available indicators. You can tell from this window which indicators you are currently viewing on your chart because a checkmark appears next to each live indicator. To add a new indicator to your chart, click on the name of the indicator you would like to add

Indicators

A technical indicator is a series of data points that are derived by applying a formula to the price data of a security. Price data includes any combination of the open, high, low or close over a period of time. Some indicators may use only the closing prices, while others incorporate volume and open interest into their formulas. The price data is entered into the formula and a data point is produced.

- MA - Moving Average: Moving averages are used to emphasize the direction of a trend and to smooth out price and volume fluctuations, or "noise", that can confuse interpretation. Typically, upward momentum is confirmed when a short-term average (e.g.15-day) crosses above a longer-term average (e.g. 50-day). Downward momentum is confirmed when a short-term average crosses below a long-term average.

- HVD - Historical Volume Distribution: HVD is a Price Activity (PAC) chart that is plotted on a main chart. It tracks and compounds volume (the number of shares traded) at each price level. HVD is color coded directly in the stock chart.

- EMA - Exponential Moving Average: A type of moving average that is similar to a simple moving average, except that more weight is given to the latest data. The exponential moving average is also known as "exponentially weighted moving average".

- BOLL - Bollinger Bands: Developed by John Bollinger, Bollinger Bands are volatility bands that are placed above and below a moving average. The moving average represents the average price over a specific period, which smooths the price series. Volatility is based on the standard deviation. Because Bollinger Bands are based on volatility, they automatically adapt to price changes. There are three components to the Bollinger Band indicator:

- Moving Average: By default, a 20-period simple moving average is used.

- Upper Band: The upper band is usually 2 standard deviations (calculated from 20-periods of closing data) above the moving average.

- Lower Band: The lower band is usually 2 standard deviations below the moving average.

- BIAS - Bias To Moving Average: BIAS is an Enveloped Moving Average indicator, it consist of a moving average plus and minus percentage deviation. BIAS serves as an indicator of overbought or oversold conditions, visual representations of price trend, and an indicator of price breakouts.

- DMI - Directional Movement Index: An indicator developed by J. Welles Wilder for identifying when a definable trend is present in an instrument. That is, the DMI tells whether an instrument is trending or not. Directional Movement Index (DMI) consists of two lines, the DMI plus line (DMI+) and the DMI minus line (DMI-), which generate buy and sell signals.

- MTM - Momentum: Momentum oscillator plots the difference between the current point and the point N periods ago. It measures the rate of change of price across a number of days in order to establish the security’s price over a particular period of time. The indicator is always used for identifying trends, overbought/oversold conditions and divergences. It is important to note that it is always calculated with its values being unrelated to the price scale.

- OBV - On Balance Volume: OBV is a simple indicator that adds a period's volume when the close is up and subtracts the period's volume when the close is down. A cumulative total of the volume additions and subtractions forms the OBV line. This line can then be compared with the price chart of the underlying security to look for divergences or confirmation.

- MFI - Money Flow Index: A momentum indicator that is used to determine the conviction in a current trend by analyzing the price and volume of a given security. The MFI is used as a measure of the strength of money going in and out of a security and can be used to predict a trend reversal. The MFI is range-bound between 0 and 100 and is interpreted in a similar fashion as the RSI. The difference between RSI/MFI is that the MFI also accounts for volume, whereas the RSI only incorporates price

- GMMA - Guppy Multiple Moving Average: GMMA is used to identify changing trends. The technique consists of combining two groups of moving averages with differing time periods. One set of moving averages in GMMA has a relatively brief time frame and is used to determine the activity of short-term traders. The number of days used in the set of short-term averages is usually 3, 5, 8, 10, 12 or 15. The other group of averages is created with extended time periods and is used to gauge the activity of long-term investors. The long-term averages usually use periods of 30, 35, 40, 45, 50 or 60 days.

- VOL - Volume: The number of shares or contracts traded in a security or an entire market during a given period of time. Volume is an important indicator in technical analysis as it is used to measure the worth of a market move. If the markets have made strong price move either up or down the perceived strength of that move depends on the volume for that period. The higher the volume during that price move the more significant the move.

- ZIGZAG - ZigZag: A trend following indicator that is used to predict when a given security's momentum is reversing. The indicator is used to eliminate random price fluctuations and attempts to profit when the trend changes. The Zig Zag tool is often used in wave analysis to determine the positioning of the stock in the overall cycle.

Oscillators

An oscillator is an indicator that fluctuates above and below a centerline or between set levels as its value changes over time. Oscillators can remain at extreme levels (overbought or oversold) for extended periods, but they cannot trend for a sustained period. In contrast, a security or a cumulative indicator like On-Balance-Volume (OBV) can trend as it continually increases or decreases in value over a sustained period of time.

Oscillators are further separated into so called Centered Oscillators and Banded Oscillators. Centered oscillators fluctuate above and below a central point or line. These oscillators are good for identifying the strength or weakness, or direction, of momentum behind a security's move. For example, MACD (see below) is a Centered Oscillator whereas Stochastic is a Banded Oscillator.

- KD - Stochastics: Stochastics oscillator is a momentum indicator that uses support and resistance levels. The term stochastic refers to the location of a current price in relation to its price range over a period of time. This method attempts to predict price turning points by comparing the closing price of a security to its price range. The theory behind this indicator is that in an upward-trending market, prices tend to close near their high, and during a downward-trending market, prices tend to close near their low. Transaction signals occur when the %K crosses through a three-period moving average called the "%D".

- MACD - Moving Average Convergence/Divergence: An indicator developed by Gerald Appel that is calculated by subtracting the 26-period exponential moving average of a given security from its 12-period exponential moving average. By comparing moving averages, MACD displays trend following characteristics, and by plotting the difference of the moving averages as an oscillator, MACD displays momentum characteristics.

- ROC - Rate of Change: ROC is similar to MTM as it measures the margin between the present price and the one that existed n-time periods ago. ROC increases when the prices trend up whether it declines when they trend down. The scale of the prices changes calls the corresponding ROC change as the the speed of change. An upward surge in the Rate-of-Change reflects a sharp advance in prices. A downward plunge indicates a steep decline in prices.

- RSI - Relative Strength Index: RSI is another momentum oscillator, measuring the velocity and magnitude of directional price movements. Momentum is the rate of the rise or fall in price. The RSI computes momentum as the ratio of higher closes to lower closes: stocks which have had more or stronger positive changes have a higher RSI than stocks which have had more or stronger negative changes. The RSI is most typically used on a 14 day timeframe, measured on a scale from 0 to 100, with high and low levels marked at 70 and 30, respectively. Traditionally, RSI is considered overbought when above 70 and oversold when below 30.

- WMS - Williams %R: Williams Percent Range is similar to RSI -- as with the RSI the %R always falls between a value of 100 and 0 and two horizontal lines can normally be defaulted to represent the -20% and -80% overbought and oversold levels.

- SAR - Parabolic Time Price: The Parabolic Time/Price is used to set trailing price stops and is sometimes referred to as the "SAR" (stop-and-reversal), Parabolic SAR is more popular for setting stops than for establishing direction or trend. The dotted lines below the price establish the trailing stop for a long position and the lines above establish the trailing stop for a short position. At the beginning of the move, the Parabolic SAR will provide a greater cushion between the price and the trailing stop. As the move gets underway, the distance between the price and the indicator will shrink, thus making for a tighter stop-loss as the price moves in a favorable direction.

- CCI - Commodity Channel Index: CCI is an oscillator used to help determine when an investment vehicle has been overbought and oversold. CCI was first developed by Donald Lambert and it quantifies the relationship between the asset's price, a moving average (MA) of the asset's price, and normal deviations (D) from that average.

My Money 2.0 Manual | Investment Charts<<Previous | Next>>The Money Reports Gallery