Investment Charts

From MTHWiki

My Money 2.0 Manual | Analyze your Portfolio<<Previous | Next>>Technical Indicators and Oscillators

Contents |

Overview

Investment Charts allow for extensive study and technical analysis of a security. By default MyMoney will display a trading history as a candlestick chart plotting the span between the high and low prices of a trading period as a vertical line segment at the trading time, and the open and close prices with horizontal tick marks on the range line.

Black or red candle bodies represent a close lower than the open, while white, green or blue candles represent a close higher than the open price.

You can switch between chart types, for example you can replace Candlestic chart with a LineChart, which simply connects the closing price values with line segments.

There are two kinds of analysis that could be performed:

- Chart Drawings/Overlays, and

- Technical Indicators

As illustrated below, Chart window is split between main chart window and technical indicators displays. Chart drawings/overlays could be plotted manually on a main chart window to indicate trending or to help with recognizing chart patterns. To plot a new Chart Drawing please select Pick Investment Chart Drawing tool, place your mouse cursor on the main chart and click on the area you want to plot the drawing on. If you want to remove the drawing please first select it and then press Remove Investment Chart Drawing

Technical Indicators are not manually editable, they open in their own windows and are based on rules based on price and volume transformations, such as the relative strength index, moving averages, regressions, inter-market and intra-market price correlations, cycles, etc.

Toolbars

Main toolbar:

Description:

Chart Drawings

MyMoney supports the following predefined drawings:

Fibonacci Sequences: Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, and so on. These numbers interrelate in a variety of ways - for example, any given number is approximately 1.618 times the preceding number and any given number is approximately 0.618 times the following number.

Interpretation of the Fibonacci numbers in technical analysis anticipates changes in trends as prices tend to be near lines created by the Fibonacci studies.

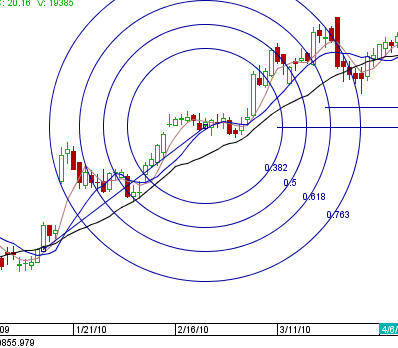

- Fibonacci Arcs: Fibonacci arcs are created by first drawing an invisible trendline between two points (usually the high and low in a given period), and then by drawing three curves that intersect this trendline at the key Fibonacci levels of 38.2%, 50% and 61.8%. Transaction decisions are made when the price of the asset crosses through these key levels.

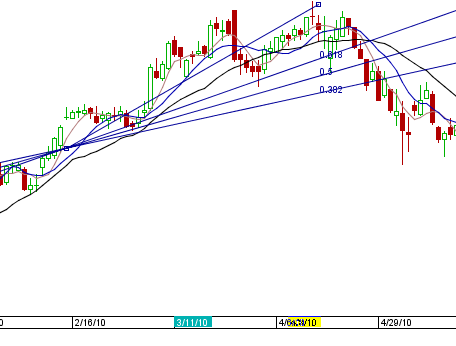

- Fibonacci Fan Lines: Fibonacci fans are created by first drawing a trendline through two points (usually the high and low in a given period), and then by dividing the vertical distance between the two points by the key Fibonacci ratios of 38.2%, 50% and 61.8%. The result of these divisions each represent a point within the vertical distance. The three 'fan' lines are then created by drawing a line from the leftmost point to each of the three representing a Fibonacci ratio.

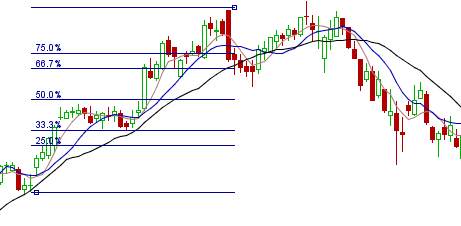

- Fibonacci Horizontal and Vertical Retracements: A term used in technical analysis that refers to the likelihood that a financial asset's price will retrace a large portion of an original move and find support or resistance at the key Fibonacci levels before it continues in the original direction. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

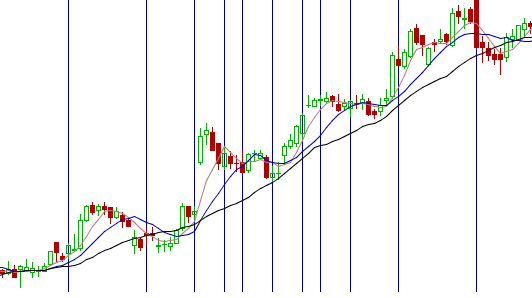

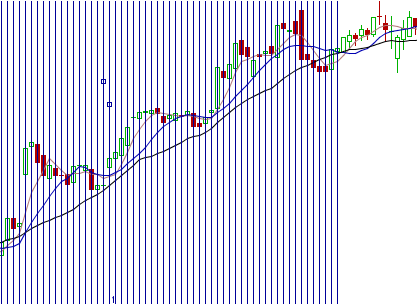

- Fibonacci TimeZones: An indicator used identify periods in which the price of an asset will experience a significant amount of movement. This charting technique consists of a series of vertical lines that correspond to the sequence of numbers known as Fibonacci numbers (1, 2, 3, 5, 8, 13, 21, 34, etc.) Once a trader chooses a starting position (most commonly following a major move) on the chart, a vertical line is placed on every subsequent day that corresponds to the position in the Fibonacci number sequence.

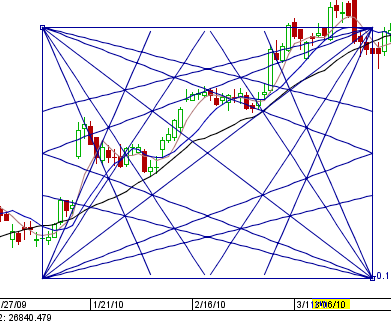

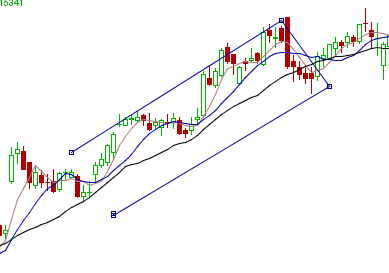

- Gann Angle: A method of predicting price movements through the relation of geometric angles in charts depicting time and price. The ideal balance between time and price exists when prices move identically to time, which occurs when the Gann angle is at 45 degrees. In total, there are nine different Gann angles that are important for identifying trend lines and market actions. When one of these trend lines is broken, the following angle will provide support or resistance

See detailed Gann Theory article on Wikipedia

- Gann Periods: Similar to Fibonacci TimeZones, this indicator will identify periods in which the price of an asset will experience a significant amount of movement. This charting technique consists of a series of vertical lines that correspond to the sequence of numbers identified by Gann periods

- Parallel Lines: You can place Parallel lines on a chart to identify trendlines, this is commonly used to show direction and speed of price.

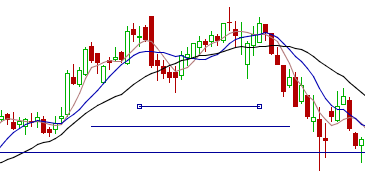

- Percent: You can quickly calculate percentages between two point by placing and then dragging Percent indicator on a chart

- Periods: You can break the chart into any number of arbitrary periods by placing and then dragging Periods indicator

- Poly-Straight Line Segment: You can draw a poly line on a chart, for example to highlight a particular period on a chart

- Straight Line and Straight Line Segment: Use this indicators to draw straight lines on the chart

Technical Indicators

Please see Technical Indicators and Oscillators

My Money 2.0 Manual | Analyze your Portfolio<<Previous | Next>>Technical Indicators and Oscillators